Form 8689 — Allocation of Individual Income Tax to the SVI: A Summary This

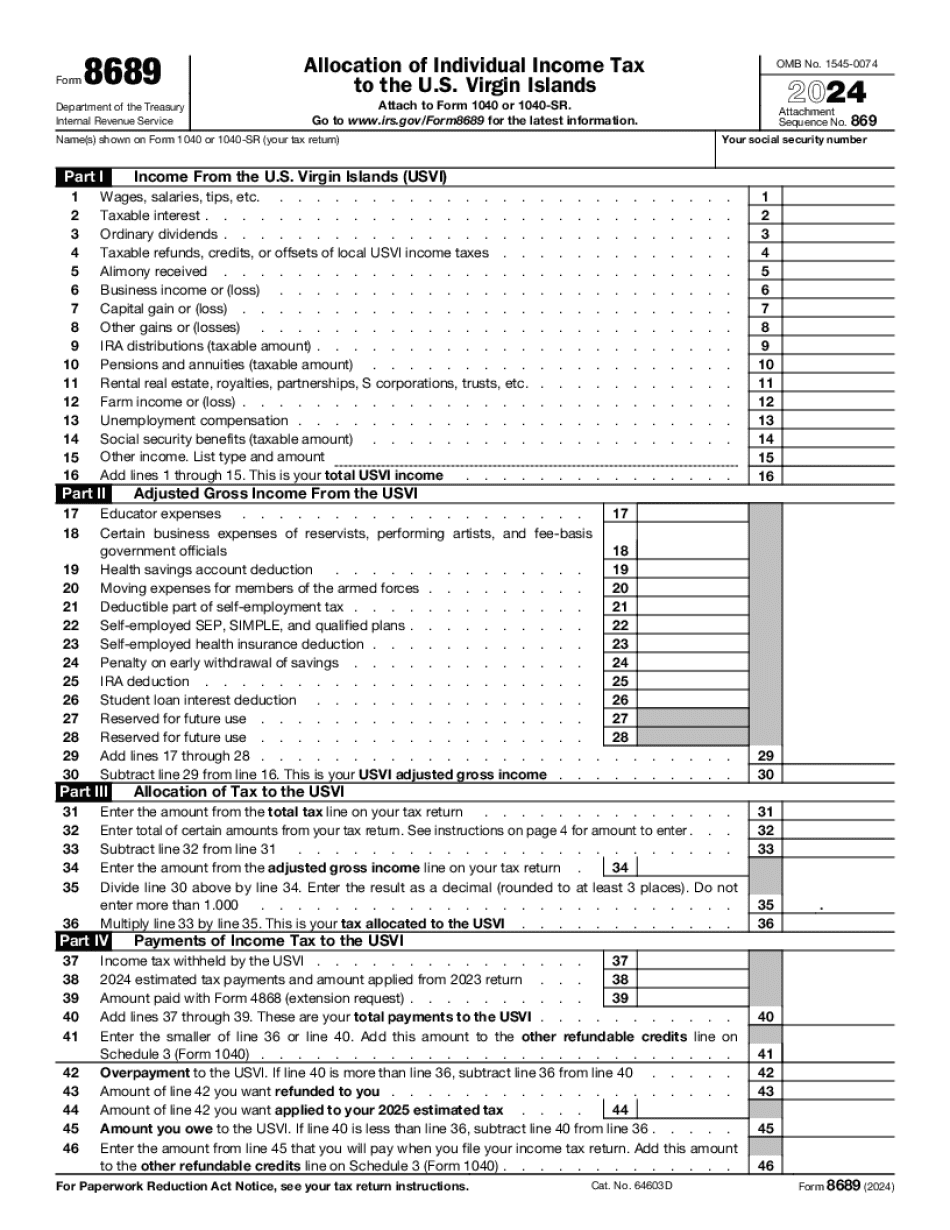

For a summary of this bulletin, please click here. Form 8689 — Allocation of Individual Income Tax to the SVI: A Summary This bulletin is being issued to provide general information to a taxpayer concerning Form 8689, allocation of individual income tax to the United States Virgin Islands (SVI), which is issued to taxpayers who owe tax with respect to the tax year ending on December 31, 1982. This bulletin is not a code book and is not intended or written to provide tax advice to anyone. Please be sure to check the information that you receive from the Internal Revenue Service carefully before filing your return or claim. The information in this release is in Appendix A of our Form 1040, U.S. Individual Income Tax Return. If you have any questions about anything contained herein (or that you should not fill out on this return because of a problem that we may have with the information therein), contact our offices at 800-TAX-FORM) or write to us at IRS Taxpayer Services Division. This publication is being mailed to taxpayers in the SVI who owe tax with respect to the tax year ending on December 31, 1982. If you pay any tax with respect to the tax year ending on December 31, 1982, please be sure to include a copy of this form within the envelope with your return if your tax return is not mailed to you. For further questions, including about whether and when we will send more information, please contact your local SVI Revenue Office. Back to top Allocation.

If you use Form 8689 to increase your U.S. residency, it allows you to file

This form provides information about your U.S. residency and income. The form also details where much of your income will be taxed in the future, if you become a resident of the U.S. Virgin Islands. You can download the roller sheet to the right or complete and file Form 8689 in person at any IRS office, or file online at the IRS website at. If you use Form 8689 to increase your U.S. residency, it allows you to file U.S. federal and state income tax returns for the years in which you become a resident of the U.S. Virgin Islands, for the calendar year in which you become a resident, and for each year that you continue to reside in the U.S. Virgin Islands. If you use Form 8689 to decrease that residency as the result of an international marriage, the IRS will reduce the amount of taxes you had to pay if your spouse becomes a resident of the U.S. Virgin Islands under the same circumstances you did. The filing form is needed only once. Form 8621: Annual Information Return for Tax-Exempt Organizations or Institutions Download Fillable PDF or Fill Online Forms 8621 (PDF) (ZIP): Form 8641, Return of Transfers of Qualified Charitable Contributions; and Form 8802, Notice of Tax Noncompliance. This form must be filed each year in order to avoid double taxation in the year it's filed. Form 8621 contains various information about an organization that is not required to be given on Form 8802. Forms 8641, 8802, and Form 8802 are also required to list each donor's relationship and source.

Box 1003 Greensboro, NC 27 Form 8689-A U.S. citizen or resident who is not a

S. Government (whether as an individual or as an entity) for a person, entity or other activity subject to taxation under U.S. income tax laws. This form must be printed on letterhead stationery of the U.S. Treasury, at the address below: U.S. Treasury. U. S. Virgin Islands Finance Office 3381 Saint Joseph Drive P.O. Box 1003 Greensboro, NC 27 Form 8689-A U.S. citizen or resident who is not a bona fide resident of a taxing jurisdiction other than a U.S. jurisdiction or a person, entity or other activity subject to taxation under U.S. income tax laws. This form must be printed on letterhead stationery of the U.S. Treasury, at the address below, and forwarded to: U.S. Treasury. Sue M. O'Donnell Chief, Offshore Operations, Foreign Tax Division 3311 Saint Joseph.

Form 8848: U.S. For taxpayers that have any type of business in the U.S. or

New form was issued by the IRS. See: IRS Form 8689 | Virgin Islands Form 8689 | Tax Act Support. CCH Interconnect | Wolters Kluwer. Form 8848: U.S. Individual Business Taxpayer Identification Number (ITIN #) and Tax Payment Due Date. This is an important document for any U.S. citizen and resident who is involved in a business or professional enterprise in the U.S. and the U.S. Virgin Islands. For taxpayers that have any type of business in the U.S. or the U.S. Virgin Islands, filing this form is essential, because many companies and lawyers charge significantly more for filing the form for taxpayers with a tax residency status of resident alien, or a foreign-source income. Form 8848 is a U.S. Individual Taxpayer Identification Number (ITIN) and is designed for U.S. citizens and resident aliens, as well as for foreign nationals who are U.S. citizens or residents. It can be used to verify the taxpayer's identification. The form is electronically filed on CCH Interconnect (VIR) and Wolters Kluwer (WK) websites and must be received by the U.S. Social Security Administration by the applicable due date on the Form 8848. CCH Interconnect:. Wolters Kluwer:. The form must be submitted electronically and an original copy must be sent to VSC at: VSC Address: PO Box 47733, St. Petersburg, FL 33, or by email: The form will be returned to the taxpayer after receipt. See: IRS Form 8848 | U.S. Individual Business Taxpayer Identification Number (ITIN #). CCH Interconnect/WK:, Forms are.

Award-winning PDF software