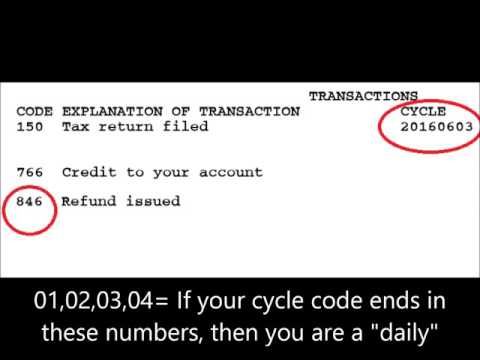

Hey everybody, it's Tanner again. I'm on part two of my tax refund tip video series for 2017. We'll continue talking about our transcripts. So if you watched my last video that I just posted, we've logged into the transcript tool and now we're going to look at just what cycle codes mean. Okay, there's going to be a very quick video. I want to clear up what it's like, of course, what a cycle code means. So I've seen on the forms, cycle code means up mom done processing. I'm going to get my review my refund tomorrow or today or, you know, people I've seen people that are correct and basically knowing that a cycle code has nothing to do with your refund. It has a little bit to do with it, but I just want to clear it up. So let's look at a tax transcript. So this one is in mind. This is another tax transcript section of a transcript that someone posted. You would find this at the bottom of the transcript and you'll see where I circled it says cycle, alright? So you see the first four digits are 2016, that's for the tax year of 2016. The next two numbers there are six, that's a week cycle of the year. And then 3 is the day cycle, so the third day of the cycle. Now what the cycle means is basically when your tax return hits the system, it gets assigned a cycle code, alright? And that's basically all it means, really, is that you've been assigned a cycle code. Mister means your return has officially started processing. Now, one thing about the cycle code is it can tell you, and I was true you've heard this terminology before, if you're trying to...

Award-winning PDF software

Pub 570 irs Form: What You Should Know

Your Tax Refund Form 1099-A is one of four forms that may appear on the W-2 of your employer and are used to report the payment you received from your employer. The payment is not for your wages, What Is a Payment From Your Employer? W-2 You may be surprised to see that the W-2 you report to the IRS includes information about other people and businesses. This is true even if you do not claim Form W-2 as a separate item on your tax return. In fact, if your employer provides an electronic service or a computer-based payroll system, the employer may transmit payments to the IRS and, in the future, you may be obligated to file a Form 1099-A reporting the payments. When an employer transmits a payment or offers an incentive to you, it has to report that payment in the Form 1099. When you receive other kinds of paid, taxable information, you must file a separate Form 1099. You The Forms 1099-A are also filed on behalf of an individual who is not required to file tax returns. If you receive Form 1099-A, and it is for you, it is called a W-2G, which you do not need to file a return for. If you receive Form 1099-A for a child, parent, grandchild, spouse, or grandparent without the individual not being self-employed, you should file both the W-2G and the Form 1099, so your income is reported correctly, and you can claim your refund in a timely manner. When Does Form 1099-A Appear? When a borrower takes out a loan from their bank or a mortgage broker, they are usually responsible for paying the loan in full before the end of the year. If a borrower takes out a loan but then fails to pay it on time, they receive notice of that failure from the lender. This notice includes a Form 1099-A, which they would then use to report the payment on their income tax return. The notice is used because the unpaid amount has been paid by the time the lender determines the borrower cannot pay all the debt. Form 1099-A is not required for an unsecured loan or a home equity loan. Form 1099-A: Acquisition or Abandonment of Secured Property is also used for certain tax benefits.

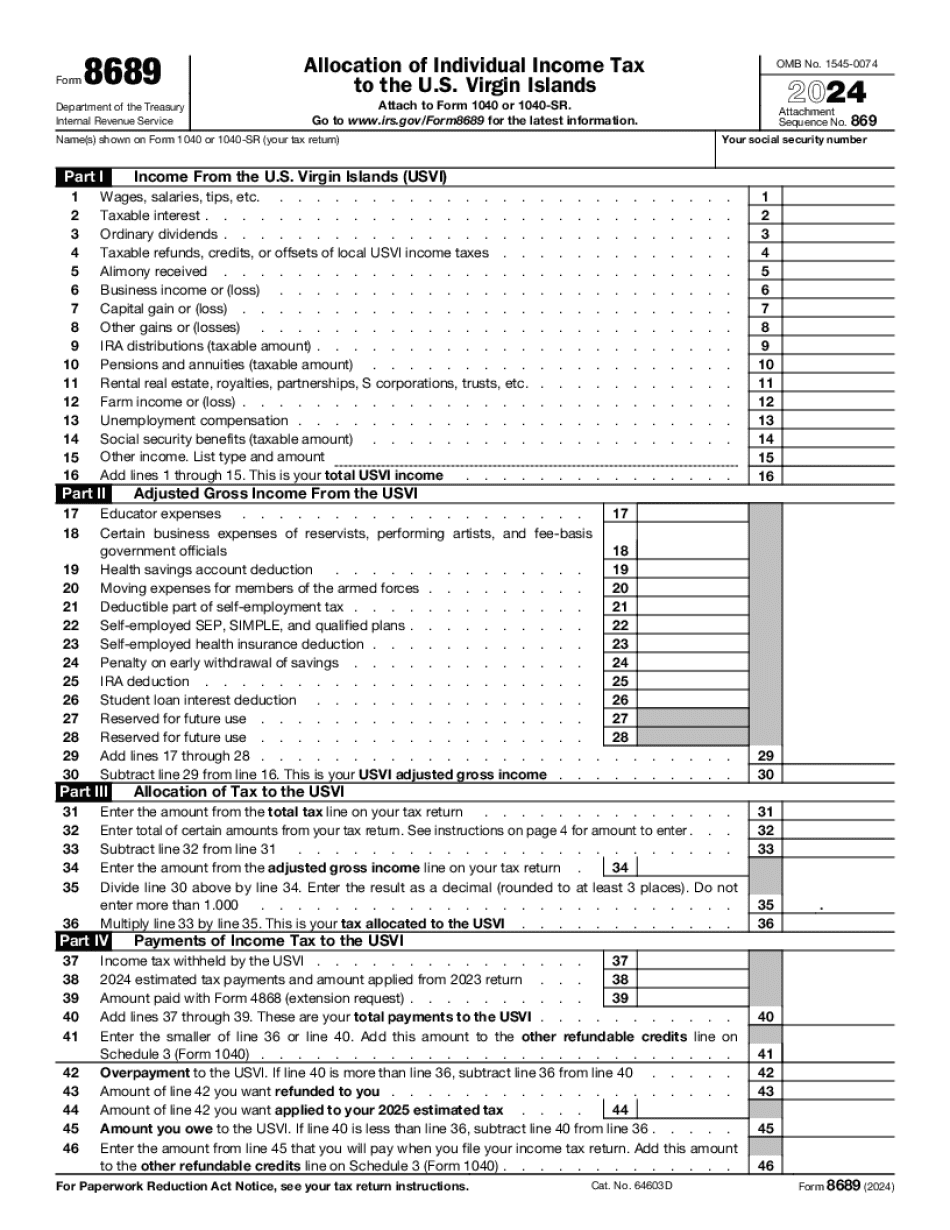

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8689, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8689 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in Your Form 8689 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to Your Form 8689 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Pub 570 irs