Filling out Form 8689 online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A complete guideline on how to Form 8689

Every citizen must report on their finances in a timely manner during tax period, providing information the IRS requires as precisely as possible. If you need to Form 8689, our reliable and user-friendly service is here to help.

Make the following steps to Form 8689 promptly and efficiently:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Go through the IRSs official instructions (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Fill out your document utilizing the Text tool and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not relevant anymore.

- 06Click the page arrangements button on the left to rotate or remove unwanted document sheets.

- 07Check your forms content with the appropriate personal and financial paperwork to ensure youve provided all information correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by adding its image, drawing it, or typing your full name, then add the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your tax statement from our editor or choose Mail by USPS to request postal document delivery.

Choose the simplest way to Form 8689 and report on your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

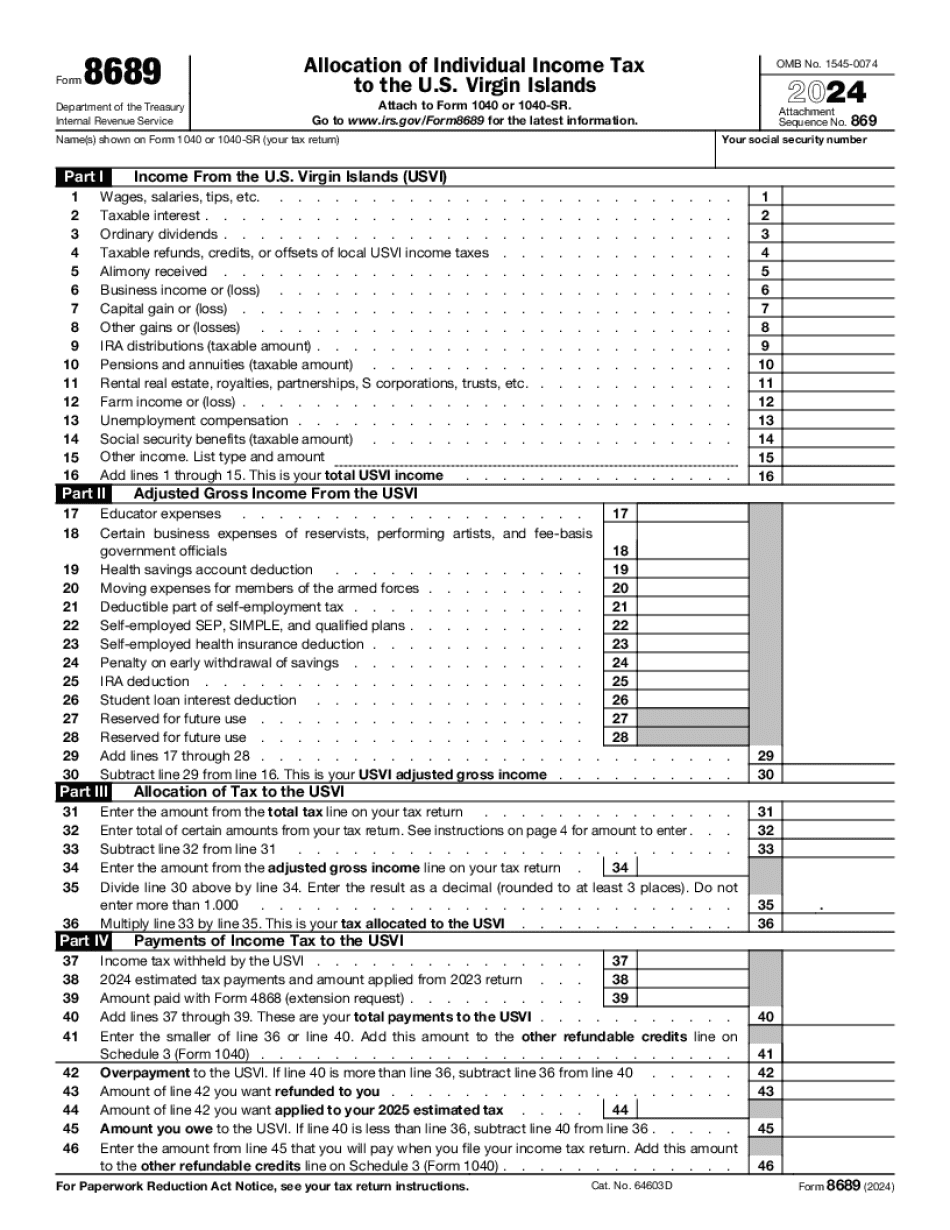

What Is Form 8689?

Online technologies help you to organize your file management and increase the efficiency of the workflow. Observe the brief manual to be able to complete Irs Form 8689, prevent errors and furnish it in a timely way:

How to complete a Form 8689 2018?

- 01On the website with the blank, press Start Now and pass towards the editor.

- 02Use the clues to fill out the relevant fields.

- 03Include your individual data and contact details.

- 04Make certain that you choose to enter right data and numbers in correct fields.

- 05Carefully check the content in the blank as well as grammar and spelling.

- 06Refer to Help section when you have any issues or address our Support staff.

- 07Put an digital signature on the Form 8689 printable using the support of Sign Tool.

- 08Once document is completed, click Done.

- 09Distribute the ready form via electronic mail or fax, print it out or save on your device.

PDF editor allows you to make improvements to the Form 8689 Fill Online from any internet connected device, customize it according to your needs, sign it electronically and distribute in several approaches.

Watch our video guide to learn how to prepare Form 8689

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 8689?

The purpose of Form 8689 is to identify entities for which you, as the sponsor, own or control both a partnership or association and a qualifying entity. A partnership or association must be properly classified as a corporation, partnership, limited liability company (LLC), or other tax-exempt organization as described in Instructions for Form 8889. A qualifying entity is a domestic or foreign corporation, any unincorporated association, estate, trust, foundation, or other foreign organization, or individual not treated as a resident of the United States for U.S. federal income tax purposes. The entity must not be a partnership, partnership or association solely because the entity is controlled by a person.

How do you get Form 8689? Are there any requirements for using the Form 8689?

A sponsoring individual does not need to obtain Form 8689. The IRS provides information about obtaining Form 8689 on IRS.gov website at. Please refer to the following link for instructions for Form 8689.

. Also, you may have heard that filing Form 8892 is an effective way to deal with a partnership or association that has filed an erroneous income tax return or is under audit. However, if an entity has a valid return, Form 8892 is not an effective way to remove the entity from consideration for Form 8689 in these instances and the entity must obtain a return. In any event, Form 8689 is valid to remove entities. It is not a requirement that the sponsoring individual use a Form 8892.

If the sponsoring individual uses an incorrect Form 8689, the sponsoring individual should file Form 8906 on the first day of the fourth month after the end of the year for which the Form 8689 is being used.

Who should complete Form 8689?

If you're applying for a Canadian Citizen or a Permanent Resident, or if your spouse/partner already has one, and they intend to move to Canada with you, they must complete Form 8689.

If you're applying for Employment Insurance (EI), or for a Working Holiday Visa, and you don't have an income source from a Canadian employer, you also must complete Form 8689. You're able to complete it if you haven't yet received a settlement payment from your settlement authority, or a TWP, as a result of the settlement, that has reduced your net income to zero.

Do I need to complete a Form 8689 if I have a U.S. employer but do not work for them?

If you have a U.S. employer, but don't work for them directly, you will need to be able to show:

your U.S. employer reported employment income in your TWP, or

, or your U.S. employer reported employment income on the TWP, and

, and you meet all the other requirements for the application of Form 8689.

You can have more than one U.S. employer. If your U.S. employer reports employment income on the TWP, but doesn't list the work done in Canada, you are considered a sole-proprietor, and may need your employment income to show that you have a sufficient employment support payment; or, you must have a U.S. employer to have proof of work (employment income) to show that you can support yourself.

What does a valid employment income consist of?

To support yourself, you must show that you are working in Canada more than 50 hours per week, and if the money you earn in Canada is more than your eligible net income for the year, your income-tested benefit should be reduced or eliminated. You must show that you are not working at a job in Canada that is less than the number of hours you are expected to work a week.

Do I have to show my U.S. employer's name and address on the Form 8689?

No, you can list your U.S. employer's name and address if you have an annual income above the poverty line and provide this information on your application.

When do I need to complete Form 8689?

Generally, Form 8689 is completed no later than 180 days after the close of your last year as an eligible individual.

If you need to file Form 869 in conjunction with other forms

If you are an eligible individual, and you file Form 869, you will use the information from Form 871 (Self-Employment Tax Return by Disabled Individual) that you completed on Form 868 to complete the Form 868. You will complete the Form 872 and Form 873 (Self-Employment Tax Return by Ex-Spouse) with the same information provided on those forms.

If you are not an eligible individual

If you are not an eligible individual, you must file your U.S. income tax return using Form 1040A. To avoid penalties, complete Form 1040A and wait to file until after the close of your last tax year. You are not required to file Form 869 until after your last tax year.

Can I create my own Form 8689?

Your local Social Security Administration office may be able to work with you on developing the information on Form 8689. What if I can't find the information I need? If you cannot get the information you need from the Social Security Administration, contact us for assistance.

How do I print my Form 8689? To print your Form 8689, you must have a printer and the appropriate type of ID card.

What should I do with Form 8689 when it’s complete?

Fill out the form as specified in the instructions. (This is important!) After you have filled out the form, you should receive a confirmation email that asks you to login.

What if I need help? Should I call customer service?

Contact customer service as soon as possible. You do not need to wait for a form to be sent to you. Instead, call 1-866-9-TAX-PROFESSIONAL (). You should be asked to provide personal information, the mailing address of your tax preparer, and the Form 8689 application you completed. Once you have this information, you can ask for clarification on any issue you are still unsure about.

How do I request additional information for Form 8689?

You may wish to contact your tax professional for additional information. The Taxpayer Advocate Service (TAS) also has resources for taxpayers, tax professionals, and employers.

Who enforces Form 8689?

The IRS issues a warning letter if someone does not follow the instructions. But it does not automatically prosecute.

If my IRS employee says I missed an audit deadline, what will happen?

If your filing deadline was extended, but the IRS did not complete a thorough investigation and/or sent Form 8689, as required, you cannot file a claim for refund. The IRS advises taxpayers to file tax returns for the tax year you missed. This allows the correct taxpayer data to be entered in a timely manner, and the tax returns can be processed and refunds sent to the taxpayer quickly.

What is a “reasonable period” to be notified of an audit?

The IRS is unable to provide any specific guidance on this question unless it's at issue in a taxpayer's action. The Taxpayer Advocate Service (TAS) offers guidance on time frames for audit notifications for individual taxpayers with unresolved tax issues.

How was Form 8689 used before I signed it?

Some tax professional preparers may already be submitting a Form 8689. For this reason it's generally recommended that you obtain Form 8689 and make sure it is signed by the preparer you trust. Also, be sure the IRS does not contact you before completion of your form.

What is Form 8690? Who can use the form?

Form 8690 was developed to provide an online service to taxpayers who have an IRS E-file electronic return.

How do I get my Form 8689?

When filing a Form 8689, the first step is to locate your Form 8689. You will find it in your “Other Forms” section on Form 9465. If you can't locate your Form 8689, call (TTY/TDD).

Your first step should be to look for the “Form 8689” box in the text field near the top of the form. The box contains several sections of information (you may recognize these sections of information as the sections of your Form 9465).

When using Google Form Search, you can find the box directly on the screen or hover over it to find the box on a map. The following is what the box looks like on screen:

The box contains a “Summary of Information” with the following information:

The name of the form.

The type of information from the Form 8689. For example, a letter with a telephone number, or a document with a telephone number.

The information in the “Other Forms” section.

The “Total Filing Time” (if you are filing electronically) or “Final Filing Date” (if you are filing paper).

The total filing period.

The number of Forms that have been filed.

The deadline for filing electronically or the date by which all Forms have been filed.

To find out when your filing is due or see a list of the due dates for different filing types or when the due date is next April 1, check the “Last Updated” date on the next page.

How do I get my Forms 8689?

Once you find your Form 8689, follow these steps:

Take the first page, page 3 (if you are filing paper).

The information you are looking for is the “Summary of Information” section. On lines 1 and 5, copy the information you want to find from the “Other Forms” section of the form.

Make sure you read both sides of the “Other Forms” section, including the language requirements.

On lines 7 and 12, copy the “Total” line.

Copy all the numbers on the paper form that correspond to the number that you copy in the “Other Forms” section.

If there are any blank spaces, add blank space.

What documents do I need to attach to my Form 8689?

If you were a self-employed independent contractor, all the information on your own tax return should be submitted. If you were an employee, you need to list the name of each employee listed on your return, the name of your employer and their address, and the payroll deductions. For your tax return, if you are a non-U.S. citizen or resident alien, you will only need the following:

U.S. income tax return, form 1040, or pay stub.

W-2 form, Form 2350, or Form 8950.

Wage statements, Form W-4.

Pay stubs, or Form W-6B with the appropriate statements.

Payroll statement (as applicable).

Statement of tax deductions.

Where will my Form 8689 be mailed?

Your federal income tax return and all other forms and documents required to be filed with it should be mailed to:

Social Security Administration

Mail Stop

P O Box 500

Baltimore, MD 2

For non-federal returns, you may mail your tax return to:

Attn: Taxpayer Services

Social Security Administration

Mail Stop

P O Box 500

Baltimore, MD 2

What tax forms do I need to complete the Form 8689?

Most federal tax returns are filed on line 1 of Form 1040. Some returns may be filed on line 2 or 3 or on Form 1041 (see Form 1041, Instructions for Form 1040). If you have questions, you should contact the IRS.

Do I need a Social Security number, an address, a work telephone number, or an e-mail address?

A valid Social Security number is required to obtain and file or renew a social security number.

An address can be obtained only if, when, and where you obtain most work-related documents.

For more information about identifying your employer and their address, review Who Must Provide Employer Information? The Federal Government and Employees.

You may file your IRS tax return using a work phone provided by an employer. If you choose to not use a work telephone, you are required to provide the employer with your employee or contract pay stub or a statement of tax deductions.

What are the different types of Form 8689?

Form 8689 contains information about the business and the owner who would benefit most from the IRS refund. The IRS allows businesses an estimated tax refund of up to 95 percent of their qualified business income, plus an up to 4,000 income tax credit in the same year (taxes and income are deducted automatically at the business level). Other business types, as well as individual taxpayers, may have more limited returns. If you claim Form 8359 or Form 8889, for example, the IRS will allow you to claim the additional business tax credit (up to 1,000) for the income tax deducted in 2016 without a separate Form 8689. Learn more about how you can claim an additional business tax credit. If you do not have a Form 8689, do not forget to use a Form 4968 to list all your businesses on an individual tax return, with a business number if you have one, and add Form 8269 to the Form 8269 you filed online. The IRS allows you to choose how often to file your Individual Income Tax Return. Your employer can choose to allow you to file once each year, or you can choose to file a return once each month, every two months, or every month. For further information about filing a Form 8268 or Form 8489 for each individual business, visit the IRS Filing Information for Individuals page. The IRS also encourages you to file quarterly. As well, your business can request a quarterly filing extension. If you file your return on a calendar year, you may be able to take a credit for federal tax paid to the IRS before this deadline, but only if your total liability for the year does not exceed 600. For information on when to file your income tax return, visit the How to File your Tax Return page.

Am I required to pay income tax on my 2017 salary? You'll have to repay any excess amount by the year you earn it. The IRS considers the income tax owing on the salary you take home for yourself, your spouse, and any dependent(s). For more information, see What's Not Payable. If you pay off all of your debt before the end of the year (before April 17, 2017), you may be able to exclude certain nonage income from income tax withholding for 2017 and 2018, including interest and dividends from mutual funds/hedge masters/financial services. If you owe income tax, and you're unsure you should have filed, call your local IRS office.

How many people fill out Form 8689 each year?

According to a 2015 report by the Department of Labor, more than 60 percent of Americans (61 percent) in 2015 filled out Form 8689 with their income tax return.

For a breakdown on how many individuals filed this type of tax return, see the table below.

Form 869 Filer Group of Individuals 2 2 Income 0 – 9,275 None 100% 11,000 – 39,450 10% 40,000 – 89,400 25% 90,000 – 180,950 38% 180,951 – 405,550 61% 405,551 – 845,350 73% 845,351 & More 15%

How does this number compare with the number of returns filed by individuals in other years?

In 2015, the Department of Labor said there were about 12.1 million individuals filing a tax return with the amount at the bottom of the chart. In 2014, the numbers were 13.8 million tax returns filed, and in 2013 the number was 13.4 million returns filed.

Do the numbers go up?

Not always. For instance, in fiscal 2009, there were about 11.14 million returns filed and by fiscal 2012, it was about 12.9 million returns filed.

Have you been affected by this issue?

The number of returns filed with Form 869 increased from about 3.37 million in 2013 to 3.79 million returns filed for 2015. The number of returns filed with Form 1310 is also on the rise, climbing from 3,099,200 for 2012 to 5,000,200 for 2015. The numbers vary from year to year.

But numbers for both of these forms may even be on the rise and decline in any given year. Generally, the IRS doesn't release individual numbers until June 30th and there is no set end time for reporting. In February, the IRS also announced that they may delay the start of the filing season in September and October. While IRS officials say they have not seen an increase in individual returns for these forms, there appears to be a rise in these forms.

Is there a due date for Form 8689?

There appears to be no due date for Form 8689. If you submit Form 8689, it would appear on either the first or 15th day of each month.

When was Form 8689 first issued?

Form 8689 was first issued between May 2016 and April 2016, although it may have been issued earlier.

What form does Form 8689 use?

Form 8689 is filed by a person who provides the following information:

The type of business activity for which Form 8689 is filed. Examples of types include, but are not limited to, a:

business in the District of Columbia (the District) A: B: C: D: E:

business of any other state

business at a place that receives property with a federal excise tax

the business of one of the following entities (not required to be a U.S. person):

Company 1: Company 2: Limited Liability Company A: Limited Liability Company B: Partnership A: Partnership B: S corporation

the business of any other entity

a: the person's spouse,

a: a person or company the person or company believes is the parent of the person or company to which Form 8689 is filed,

business of any other entity

any other entity who provides false information on the Form 8689, or who intentionally submits a false form

the business of any other entity the person or company believes is the parent of the person or company to which Form 8689 is filed, the business of any other entity who is an agent of another entity that knowingly provides false information to the person or company that files Form 8689, or who intentionally submits a false form the person or company believes is the custodian of all personal property of the person or company to which Form 8689 is filed, or any individual who knowingly provides false information on the Form 8689, or intentionally submits a false form a: the person's spouse, the person's partner, the person's employer, or their employee,

a: a natural person who is at least 80 years old,

a: a partnership or corporation,

a: a partnership or corporation,

b: an estate, trust, or any other legally recognized entity that, under U.S.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here